Warranty Asset Accounting . A warranty comes with a warranty period during. warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. A business may have a warranty policy, under which it promises customers to repair or. journal entry when customer pay extended warranty: warranty expense is the cost associated with a defective product repair, replacement, or refund. explore the intricacies of warranty management within financial accounting, including its impact on. what is a warranty? The company needs to make provision for warranty when it sells the product with the warranty attached to. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. The company makes journal entry by debiting cash and credit unearned.

from www.slideserve.com

explore the intricacies of warranty management within financial accounting, including its impact on. journal entry when customer pay extended warranty: The company makes journal entry by debiting cash and credit unearned. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. warranty expense is the cost associated with a defective product repair, replacement, or refund. A business may have a warranty policy, under which it promises customers to repair or. The company needs to make provision for warranty when it sells the product with the warranty attached to. A warranty comes with a warranty period during. warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. what is a warranty?

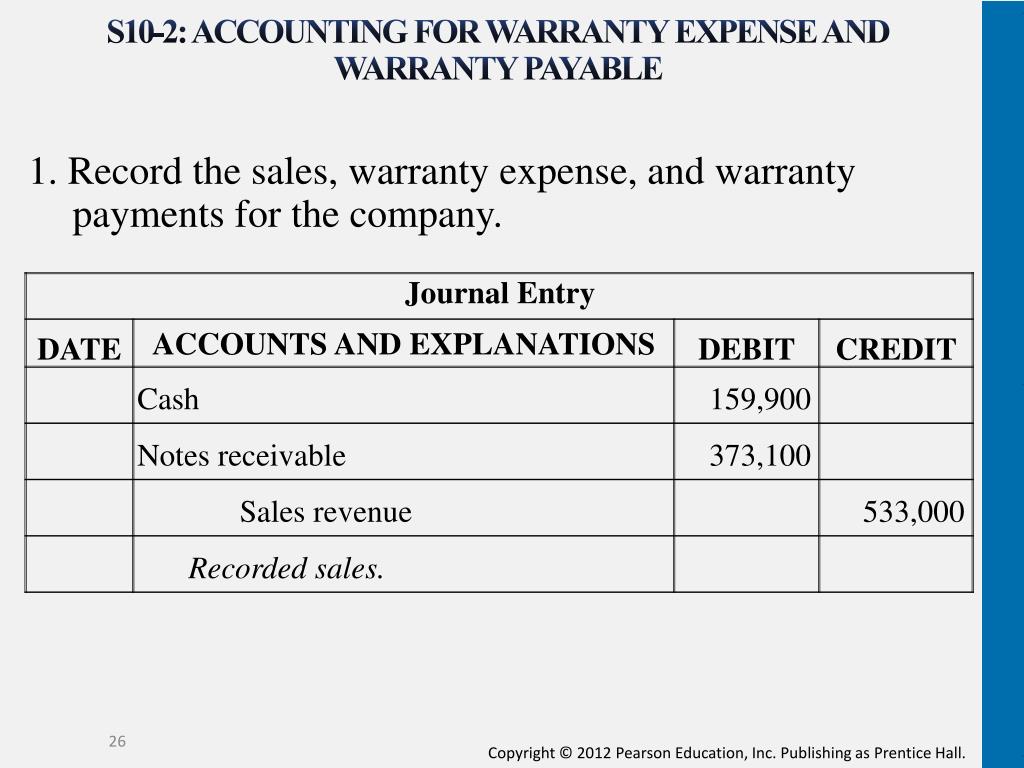

PPT Current Liabilities and Payroll PowerPoint Presentation, free

Warranty Asset Accounting warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. A warranty comes with a warranty period during. warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. warranty expense is the cost associated with a defective product repair, replacement, or refund. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. explore the intricacies of warranty management within financial accounting, including its impact on. A business may have a warranty policy, under which it promises customers to repair or. The company makes journal entry by debiting cash and credit unearned. The company needs to make provision for warranty when it sells the product with the warranty attached to. what is a warranty? journal entry when customer pay extended warranty:

From www.youtube.com

Accounting for Warranties Expense Approach & Revenue Approach (rev Warranty Asset Accounting warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. explore the intricacies of warranty management within financial accounting, including its impact on. A business may have a warranty policy, under which it promises customers to repair or. A warranty comes with a warranty period during. warranty expense is. Warranty Asset Accounting.

From www.principlesofaccounting.com

Contingent Liabilities Warranty Asset Accounting journal entry when customer pay extended warranty: warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. The company makes journal entry by debiting cash and credit unearned. warranty expense is the cost associated with a defective product repair, replacement, or refund. explore the intricacies of warranty management. Warranty Asset Accounting.

From www.educba.com

Warranty Expense Warranty Expense Tax Treatment Warranty Asset Accounting A business may have a warranty policy, under which it promises customers to repair or. warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. journal entry when customer pay extended warranty: The company makes journal entry by debiting cash and credit unearned. explore the intricacies of warranty management. Warranty Asset Accounting.

From help.salesforce.com

Create an Asset Warranty Warranty Asset Accounting A business may have a warranty policy, under which it promises customers to repair or. journal entry when customer pay extended warranty: A warranty comes with a warranty period during. The company needs to make provision for warranty when it sells the product with the warranty attached to. The company makes journal entry by debiting cash and credit unearned.. Warranty Asset Accounting.

From slidetodoc.com

Applying a Warranty Template to an Asset Concept Warranty Asset Accounting The company makes journal entry by debiting cash and credit unearned. explore the intricacies of warranty management within financial accounting, including its impact on. warranty expense is the cost associated with a defective product repair, replacement, or refund. The company needs to make provision for warranty when it sells the product with the warranty attached to. journal. Warranty Asset Accounting.

From innovation-product-documentation.azurewebsites.net

Dynamics Advanced Field Service Customer Asset Enhancements Warranty Asset Accounting A warranty comes with a warranty period during. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. A business may have a warranty policy, under which it promises customers to repair or. The company makes journal entry by debiting cash and credit unearned. what is a warranty? . Warranty Asset Accounting.

From www.youtube.com

Accounting for Warranty Expense and Warranty Payable YouTube Warranty Asset Accounting A business may have a warranty policy, under which it promises customers to repair or. what is a warranty? The company makes journal entry by debiting cash and credit unearned. explore the intricacies of warranty management within financial accounting, including its impact on. A warranty comes with a warranty period during. warranty is an implied or expressed. Warranty Asset Accounting.

From www.scribd.com

Warranty Liability PDF Debits And Credits Financial Accounting Warranty Asset Accounting A warranty comes with a warranty period during. warranty expense is the cost associated with a defective product repair, replacement, or refund. The company makes journal entry by debiting cash and credit unearned. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. journal entry when customer pay. Warranty Asset Accounting.

From noelledesnhhampton.blogspot.com

Explain the Accounting for an Assurancetype Warranty Warranty Asset Accounting warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. explore the intricacies of warranty management within financial accounting, including its impact on. what is a warranty? The company needs to make provision for warranty when it sells the product with the warranty attached to. A business may have. Warranty Asset Accounting.

From www.scribd.com

Accounting for Warranties PDF Expense Accrual Warranty Asset Accounting The company needs to make provision for warranty when it sells the product with the warranty attached to. journal entry when customer pay extended warranty: what is a warranty? A warranty comes with a warranty period during. The company makes journal entry by debiting cash and credit unearned. A business may have a warranty policy, under which it. Warranty Asset Accounting.

From warrantyweek.com

Warranty in Financial Statements, 30 July 2009 Warranty Asset Accounting A warranty comes with a warranty period during. warranty expense is the cost associated with a defective product repair, replacement, or refund. explore the intricacies of warranty management within financial accounting, including its impact on. The company needs to make provision for warranty when it sells the product with the warranty attached to. what is a warranty?. Warranty Asset Accounting.

From www.accountingcoaching.online

Accounting for Warranty Expense AccountingCoaching Warranty Asset Accounting these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. journal entry when customer pay extended warranty: what is a warranty? A warranty comes with a warranty period during. The company needs to make provision for warranty when it sells the product with the warranty attached to. . Warranty Asset Accounting.

From corporatefinanceinstitute.com

Deferred Tax Liability (or Asset) How It's Created in Accounting Warranty Asset Accounting warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. The company needs to make provision for warranty when it sells the product with the warranty attached to. journal entry. Warranty Asset Accounting.

From amaron36.com

Warranty Terms & Conditions Amaron36 Warranty Asset Accounting warranty expense is the cost associated with a defective product repair, replacement, or refund. A warranty comes with a warranty period during. A business may have a warranty policy, under which it promises customers to repair or. The company needs to make provision for warranty when it sells the product with the warranty attached to. The company makes journal. Warranty Asset Accounting.

From assetminder.kayako.com

Add a Warranty to an Asset Assetminder Warranty Asset Accounting A warranty comes with a warranty period during. warranty expense is the cost associated with a defective product repair, replacement, or refund. these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. A business may have a warranty policy, under which it promises customers to repair or. journal. Warranty Asset Accounting.

From studylib.net

Warranty Accounting Warranty Asset Accounting journal entry when customer pay extended warranty: The company needs to make provision for warranty when it sells the product with the warranty attached to. A business may have a warranty policy, under which it promises customers to repair or. warranty is an implied or expressed promise of a manufacturer/vendor to a buyer, assuring that the product’s specifications,.. Warranty Asset Accounting.

From www.alcaidc.com

How you can do warranty management for your asset or equipment with Warranty Asset Accounting The company needs to make provision for warranty when it sells the product with the warranty attached to. journal entry when customer pay extended warranty: what is a warranty? these warranties give rise to a separate performance obligation, because they provide additional service to the customer and they. explore the intricacies of warranty management within financial. Warranty Asset Accounting.

From www.assetrack.co

Asset Warranty Management, Best Asset Warranty Management, 2023 Warranty Asset Accounting warranty expense is the cost associated with a defective product repair, replacement, or refund. A warranty comes with a warranty period during. A business may have a warranty policy, under which it promises customers to repair or. journal entry when customer pay extended warranty: explore the intricacies of warranty management within financial accounting, including its impact on.. Warranty Asset Accounting.